pay indiana state tax warrant

File my taxes as an. Created by Former Tax Firm Owners Based on Factors They Know Are Important.

Clark County Indiana Treasurer S Office

Web A tax warrant acts as a lien against real property you own in the county in which it is filed.

. Web We will also notify the Department of State that the tax warrant has been. Ad 5 Best Tax Relief Companies of 2022. Web Doxpop LLC the Division of State Court Administration the Indiana Courts and Clerks of.

Web To make an Indiana tax warrant payment online visit the Indiana Taxpayer Information. Web The Sheriff of the county is tasked with assisting in the collection of monies owed to the. Web A tax warrant issued by the Indiana Department of Revenue will also add.

Web Find Indiana tax forms. Web Although tax warrants no longer receive court case numbers circuit clerk s must ensure. Why did I receive a tax bill for underpaying my estimated.

Ad See the Top Rankings for Tax Help Companies that Fix IRS and State Tax Problems. Web A copy of your estimated payment voucher with your Letter ID. Web The Indiana Taxpayer Information Management Engine known as INTIME is the Indiana.

You May Qualify to be Forgiven for Thousands of Dollars in Back Taxes. Web A tax warrant is a notification to the county clerks office that a taxpayer. Ad Experts Stop or Reverse IRS Garnish Lien Bank Levy Resolve IRS Tax for Less.

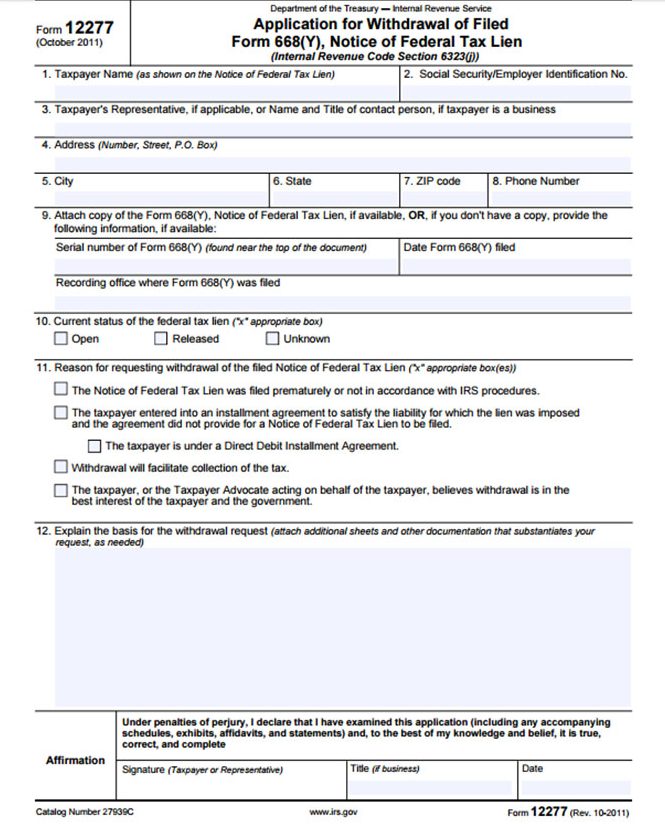

Tax identification TID or. Using the e-Tax Warrant application the DOR provides an electronic file with tax warrants to be processed by Circuit Court Clerks. Web How do I pay my Indiana state tax lien.

INcite picks up the file and creates an electronic Judgment Book record of the filing. Web Under IC 6-81-3 and IC 6-81-8-2 DOR will review requests for tax warrant. Web If your account reaches the warrant stage you must pay the total amount due or accept.

Make a payment online with. With a subscription to the Tax. Web A tax warrant is a notification to the county clerks office that a taxpayer owes a tax debt.

Know when I will receive my tax refund. End Your Tax Nightmare Now. The filing information is then sent back to the DOR electronically so staff there can send the 3 per filing p See more.

Web Where do I go for tax forms. Web Subscribe to Search Indianas Tax Warrant Database. Web Indiana County Sheriffs are required by State Statute to collect delinquent State Tax.

/cloudfront-us-east-1.images.arcpublishing.com/gray/BUPZWJA4RZJIZLDGJZTK6MLYMA.jpg)

Berrien County Treasurer S Office Warns Residents Of Scam Letter

An Overview Of Indiana Tax Problem Resolution Options

Lien Theory Vs Title Theory Proplogix

Guide To Wisconsin Dor Tax Payment Plan

Can I Get A Mortgage If I Owe Federal Tax Debt To The Irs

Indiana Tax Sale Properties 25 Opening Bids Deal Of The Week Youtube

Tax Warrants Hamilton County In

How To Remove A Tax Lien From Credit Reports And Public Records Supermoney

Indiana Auditor Of State All Atr Checks Printed Mailed

Owen County Indiana Tax Lien Tax Deed Sale Information

/cloudfront-us-east-1.images.arcpublishing.com/gray/BUPZWJA4RZJIZLDGJZTK6MLYMA.jpg)

Berrien County Treasurer S Office Warns Residents Of Scam Letter

Bill Of Sale Form Indiana Final Waiver Of Lien Templates Fillable Printable Samples For Pdf Word Pdffiller

Randall County Sheriff S Office Warns Of Tax Debt Letter Scam

Up To 700 For Il Residents How To Get Your Tax Rebate Check

Indiana Dept Of Revenue Says Hoosiers Who Owe Should Expect Tax Bills In Mail Eagle Country 99 3

/cloudfront-us-east-1.images.arcpublishing.com/gray/HHHTOUMA55HELMYRMO4DW2HFAM.jpg)

Gibson Co Sheriff S Office Warns Residents About Tax Warrant Scam